The Federal Reserve has developed a new instant payment infrastructure called the FedNow Service, a new service that allows financial institutions across the US to offer safe and efficient instant payment services to businesses and individuals.

This new system is set to revolutionize how real-time payments are made in the US, enabling financial institutions of every size to provide instant payment services to their customers.

In this blog post, we’ll provide an in-depth look at the FedNow Service, its benefits, and how financial institutions can participate in this new system.

What is the FedNow Service?

The FedNow Service is a new instant payment infrastructure developed by the Federal Reserve that allows financial institutions of every size across the US to provide safe and efficient instant payment services.

Through participating financial institutions participating in the FedNow Service, businesses and individuals can send and receive instant payments in real-time, around the clock, every day of the year.

The FedNow Service enables recipients to have full access to funds immediately, allowing for greater financial flexibility when making time-sensitive payments.

Related Reading:

The Psychology of Financial Freedom: Mindset Shifts to Help You Succeed

Benefits of the FedNow Service

The FedNow Service offers several benefits to financial institutions, businesses, and individuals, including:

- Real-time payments: The FedNow Service enables financial institutions to offer real-time payments to their customers, improving customer satisfaction and loyalty.

- Improved cash flow: Real-time payments will help businesses manage their cash flow better, allowing them to make time-sensitive payments more efficiently.

- Increased efficiency: The FedNow Service offers a more efficient way to send and receive payments, reducing the time and resources needed to complete transactions.

- Enhanced security: The FedNow Service uses advanced security measures to protect transactions, reducing the risk of fraud and cyberattacks.

- Accessibility: The FedNow Service is available to financial institutions of every size across the US, enabling every business and individual to have access to safe and efficient instant payment services.

Phased Deployment

The FedNow Service will be deployed in phases, with the initial launch taking place in July 2023.

The first release of the FedNow Service will provide baseline functionality that will support market needs for a range of use cases, including those growing in demand such as account-to-account (A2A) transfers and bill pay.

Financial institutions participating in the FedNow Service will need to integrate their systems with the FedNow Service’s application programming interfaces (APIs).

This will allow them to send and transfer funds and receive instant payments through the FedNow Service.

Download our free E-book today and start learning how to create wealth for yourself!

Innovative Instant Payment Services

Financial institutions and their service providers can use the FedNow Service to provide innovative instant payment services to their customers.

This new infrastructure will allow financial institutions to differentiate themselves from competitors by offering real-time payments, which will improve customer satisfaction and loyalty.

Related Reading:

How to be Debt-Free in 6 Months

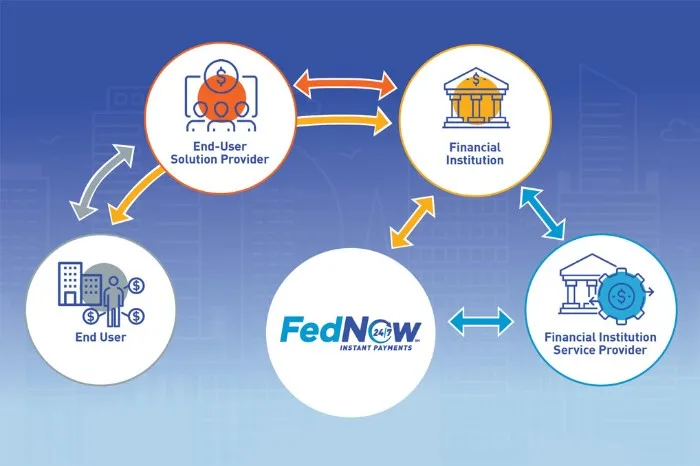

Financial Institutions’ Role in the Process

Financial institutions that want to participate in the FedNow Service will need to take several steps to integrate their systems with the FedNow Service’s APIs.

These steps include:

- Develop a business case: Financial institutions will need to develop a business case to determine the benefits of participating in the FedNow Service and whether it aligns with their strategic goals.

- Register: Financial institutions will need to register with the FedNow Service to participate in the program.

- Integrate systems: Financial institutions will need to integrate their systems with the FedNow Service’s APIs to send and receive instant payments through the system.

- Test: Financial institutions will need to test their systems to ensure they are working properly before going live with the FedNow Service.

- Launch: Financial institutions can launch their instant payment services through the FedNow Service.

The Role of Service Providers

Service providers can play an essential role in helping financial institutions participate in the FedNow Service.

Service providers can help financial institutions with system integration, testing, and the launch of their instant payment services.

They can also offer support services to ensure financial institutions are getting the most out of the FedNow Service.

Final Thoughts on FedNow

In my opinion, the FedNow Service is a total trailblazer in the financial industry once you get past its uninspiring name.

By enabling real-time payments, financial institutions and other payment systems of every size across the US can provide safe and efficient instant payment services to businesses and individuals, increasing efficiency, improving cash flow, and enhancing security.

The phased deployment of the FedNow Service will begin in July 2023, with the first release providing baseline functionality to support a range of use cases, including account-to-account transfers and bill pay.

Financial institutions that want to participate in the FedNow Service will need to register with the program and integrate their systems with the FedNow Service’s APIs.

Service providers can play a vital role in assisting financial institutions with system integration, testing, and launch of their instant payment services.

The FedNow Service is a critical step forward in the US’s efforts to modernize its payment systems and stay competitive in the global economy.

By providing real-time payment capabilities to financial institutions of every size, the FedNow Service will help drive innovation and growth, benefiting businesses and individuals alike.

For in-depth information about the FedNow Service, visit FedNow.org. To stay updated on key FedNow Service features and development.

People Also Ask About FedNow

Q: What is the FedNow Service, and how does it work?

A: The FedNow Service is a new instant payment infrastructure developed by the Federal Reserve that allows financial institutions of every size across the US to provide safe and efficient instant payment services to businesses and individuals.

It works by enabling financial institutions to send and receive instant payments in real-time, around the clock, every day of the year, using the FedNow Service’s APIs.

Q: Why is the FedNow Service important?

A: The FedNow Service is important because it enables real-time payment capabilities for financial institutions of every size across the US.

Real-time payments can increase efficiency, improve cash flow, and enhance security, benefiting businesses reserve banks and individuals alike.

The FedNow Service also helps modernize the US payment system, keeping it competitive with other countries and driving innovation and growth.

Q: When will the FedNow Service be available?

A: The phased deployment of the FedNow Service will begin in July 2023, with the first release providing baseline functionality to support a range of use cases, including account-to-account transfers and bill pay.

Q: How can financial institutions participate in the FedNow Service?

A: Financial institutions that want to participate in the FedNow Service will need to register with the program and integrate their systems with the FedNow Service’s APIs.

Service providers can play a crucial role in assisting financial institutions with system integration, testing, and launch of their instant payment services.

Q: What resources are available for financial institutions that want to learn more about the FedNow Service?

A: The Federal Reserve offers a range of resources for financial institutions looking for more in-depth information about the FedNow Service, including FedNow Explorer, webinars, FedNow News, and FedNow Service Support.

Q: What are some of the benefits of using the FedNow Service?

A: Some benefits of using the FedNow Service include faster payment processing, improved cash flow, enhanced security, and greater financial flexibility when making time-sensitive payments.

Real-time payments can also help reduce the need for costly and time-consuming manual processes, saving businesses time and money.

Related Reading: