Are you ready to transform your relationship with money and achieve financial freedom?

Achieving financial freedom is a common ambition for many, yet often feels like an unrealistic objective.

Attaining financial freedom involves much more than just earning a higher salary; it is about pursuing effective money management practices.

Discover the attitudes, habits, and mentalities that will assist you in this journey by reading through this article.

Unlock potential success as we explore the psychology of financial freedom!

The Scarcity Mindset

Constricted thinking is a pervasive attitude that can keep you from achieving financial liberation.

Fear of scarcity is at the heart of a scarcity mindset, making it difficult to make sound financial decisions and causing relentless anxiety about wealth.

To combat this, many people hoard resources in an effort to build their sense of security.

To eliminate feelings of scarcity, you must adopt a mindset of abundance.

Cultivating trust that you’ll always have enough resources available to get the job done, regardless of how difficult or resourceful it may be, is key.

To nurture a wealth mindset, center your attention on the favorable facets of your financial circumstances and consider innovative ways to cultivate more abundance in life.

Download our free E-book today and start learning how to create wealth for yourself!

The Abundance Mindset

Embracing an abundance mindset means acknowledging the infinite access to resources that are available to you.

This mindset is characterized by an upbeat attitude and the courage to take chances in order to cultivate greater abundance in your life.

To cultivate an attitude of prosperity, focus on the positive aspects of your finances.

By doing so, you will create a mindset that embraces abundance.

Embrace the assets you possess, and use your creativity to conjure up more opulence in your everyday life.

Cultivating a sense of gratitude can help you to take stock of the positive aspects in your life, and contribute towards forming an optimistic outlook.

Crucial Takeaway– Developing a mindset for financial success involves shifting your focus from short-term gains to long-term financial health, building resilience, and staying motivated through setbacks.

Related Reading:

Mastering the Strategies of Building Wealth with Rich Dad, Poor Dad

The Power of Goal Setting

Establishing objectives is crucial for attaining monetary independence.

Establishing goals is essential for keeping you engaged, encouraged, and on track to reaching your financial ambitions.

Goals provide an outlined plan that leads directly toward success.

However, not all goals are created equal.

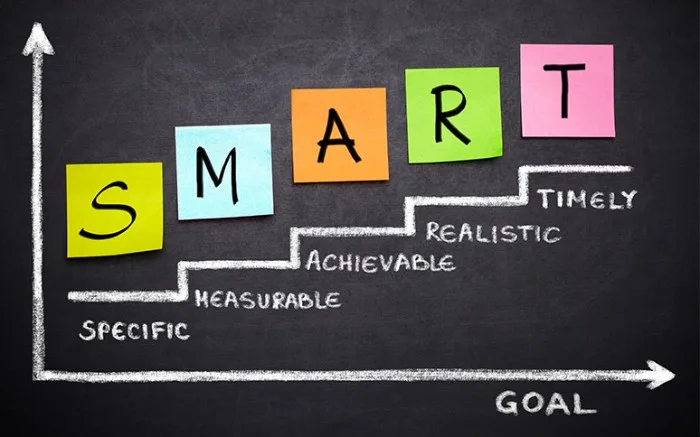

If you’re hoping to reach your financial objectives, the SMART methodology is essential.

With this strategy, it’s easier than ever before to achieve success and meet your money-related goals!

Establishing SMART goals is an excellent way to ensure success.

Your objectives must be Specific, Measurable, Achievable, Relevant to your overall vision, and Time-bound in order for them to truly have an impact.

This framework will provide you with a straightforward pathway to success by helping you establish attainable goals and assigning them due dates.

When aiming to achieve financial success, it is essential to concentrate on the things that are within your power.

You can regulate how much you save each month, nevertheless, you don’t have influence over the stock market or current economic conditions.

By putting your attention to the factors you have power over, you can consistently progress in meeting your financial goals.

Crucial Takeaway– Setting realistic financial goals requires using the SMART framework, focusing on the things that you can control, and being flexible and adjusting your goals as needed.

Overcoming Financial Anxiety

The specter of money stress hangs over many, preventing them from gaining financial independence.

Financial insecurity can be crippling; it creates a fear of not having enough money, leaving individuals feeling helpless to make the right financial decisions and almost powerless to achieve their goals.

To conquer financial stress, it is paramount that you delve into the source of your worry.

Not being informed about money, feeling helpless in your financial circumstance, and worrying that you might fail financially are all common sources of monetary stress.

To effectively combat financial stress, it is vital to actively confront the sources of your worries.

Taking concrete actions can help you alleviate any anxious feelings and regain control over your finances.

To improve your financial situation, consider expanding your knowledge of personal finances, creating a budget for yourself, and/or consulting with an expert in the field.

Establishing financial resilience is essential, and you can do this by creating a safety net of resources such as an emergency fund and planning ahead on how to handle any potential financial roadblocks.

Crucial Takeaway– Overcoming financial anxiety requires identifying the root causes of your anxiety, taking concrete steps to address them, and building financial resilience through creating an emergency fund and developing a plan for managing financial setbacks.

Related Reading:

25 Ways to Turn Your $100 Into $1000

Financial Education

The key to cultivating a successful financial lifestyle is education.

Gaining knowledge about personal finance gives you the power to understand your money and make informed decisions regarding how to use it.

It is also important to stay updated on current events related to financing so that you can anticipate any potential changes in the market, economy, and government regulations that may affect your finances.

Having a strong understanding of how the money system works can help you improve your money habits and make good decisions with regard to finance and investing.

Without financial education, it can be difficult to build your net worth and gain monetary independence.

By taking control of your financial knowledge, you will learn to manage your resources and achieve your goals.

Building a Wealth Mindset

Developing a strong, positive mindset with regard to wealth is essential for reaching financial independence.

Cultivating a wealth mindset involves concentrating on developing the lasting abundance and financial freedom.

To reach your financial goals, it is crucial to incorporate habits and behaviors that will foster success and create wealth.

It’s also wise to construct a lasting plan of action that can be followed over the course of time.

By cultivating this mindset, you will ultimately be able to gain control of your finances and create a prosperous future for yourself.

Cultivating a wealthy outlook means implementing the practices and attitudes that drive you toward your financial goals.

Establishing a budget, consistently saving money, and making prudent investments are all essential components to your financial success.

You can also focus on devising a long-term plan for achieving your financial desires, such as planning for retirement or establishing long-term investment targets.

Incorporating the habits of successful people into our lifestyle can be an enlightening and inspiring experience for developing a prosperous mindset.

Wealthy individuals understand that saving and investing are essential, live within their budget, and strive to generate multiple sources of income.

Creating a prosperous attitude towards money is not simply about accumulating wealth; it’s also about forming an advantageous relationship with financial resources.

Get a head start on your financial future by determining your values and objectives.

This will assist you in making decisions that are consistent with those long-term goals.

Crucial Takeaway– Building a wealth mindset involves prioritizing your financial objectives, aligning your financial decisions with your values and long-term goals, and seeking inspiration and guidance from successful individuals who have achieved financial success.

Positive Money Mindset

Developing a positive money mindset is the first step toward achieving financial freedom.

This involves forming a realistic, attainable outlook on money that focuses on making sound decisions with your finances and eliminating wasteful spending.

Adopting this sort of way of thinking can help you develop healthy money habits and make sensible economic choices.

It is also important to focus on creating multiple streams of income, as this can help you build a strong financial future.

Focus on taking small steps towards creating consistent cash flow; these actions will add up over time and set you up for long-term success.

By maintaining an optimistic attitude about your finances and cultivating the habits of successful people, you can create a better relationship with money and gain control of your financial future.

By doing so, you will be able to live comfortably and secure the wealth that you desire.

Related Reading:

Master Professional Investing Skills with These 21 Essential Must-Read Books

The Bottom Line

Gaining financial liberation is far more than just earning more money – it takes proper planning, discipline, and determination.

To experience success with your finances, you must adopt a new outlook that will guide you toward making more informed financial decisions and maintaining consistent motivation in the long run.

This shift of mindset will also improve your relationship with money.

Nurturing an abundance mentality, constructing SMART financial ambitions, overcoming money-related stress, and forming a wealth mindset will provide you with the basis for achieving your monetary objectives.

Investing the necessary time and effort to cultivate a new mindset can be difficult, yet its rewards will prove beneficial for years to come.

If you consistently implement even slight modifications to your routines and habits, then you can progress reliably toward attaining the financial dreams that are yours for the taking.

Make small strides today to reach the level of financial autonomy that is rightfully yours!

People Also Ask

Q: How can I cultivate an abundance mindset when I’m struggling financially?

A: Transforming your attitude to one of abundance is all about transforming your attention from what you don’t have, to that which you already possess.

It can be difficult to find gratitude when financial difficulties are weighing you down, but it is key to remember that there will always be something to appreciate.

Rather than ruminating on the resources you don’t have, direct your attention to those that do exist – such as your physical and mental well-being, supportive family members, abilities, or knowledge.

Make it a point to give thanks daily and seek out ways of fostering increased prosperity in your life.

Tap into your potential by accepting a fresh project, initiating a side hustle, or expanding your knowledge with an advantageous ability that can lead to more income in the future.

Q: How can I overcome financial anxiety?

A: Battling financial anxiety is a struggle that many people face, yet it can triumph with the right techniques.

Uncover the origin of your tension to begin tackling it.

This could be a result of inadequate financial expertise, a lack of authority over your finances, or an apprehension of economic collapse.

Once you have pinpointed the source of your issue, start taking meaningful action to address it.

To secure a brighter financial future, you may need to invest in educating yourself about personal finance, devising a budgeting plan, and/or consulting with qualified professionals for advice.

Strengthen your financial standing by setting aside funds in an emergency fund and creating a strategy to handle any unanticipated monetary issues.

Q: How can I set realistic financial goals?

A: To achieve maximum success while reaching financial goals, it is essential to implement the SMART framework.

With this system, you can set achievable objectives that are Specific, Measurable, Achievable, Relevant, and Time-based – ultimately providing an effective roadmap for long-term prosperity.

Successfully achieving your desired outcomes involves formulating goals that are precise, quantifiable, achievable, pertinent to the overall mission of your organization – and that have a strict timeline for completion.

To begin achieving your financial aspirations, you must first determine the objectives and break them into smaller, achievable goals.

Set realistic, achievable goals for yourself and give yourself a tangible timeline within which to accomplish them.

It is essential to prioritize the elements you can control, like your savings rate or debt repayment plan, while being resilient enough to modify your goals in response to any changes.

Q: How can I build a wealth mindset?

A: Establishing a mentality of prosperity requires forming habits and adopting behaviors that align with your financial goals.

To ensure a secure financial future, it is essential to begin by formulating a budget and then consistently allocate money into savings each month.

Investing your earnings wisely will also be key to achieving success.

It is paramount to concentrate on devising a lasting plan for realizing your economic objectives, such as crafting an ideal retirement portfolio or establishing long-term investment aspirations.

Establishing a wealth mindset is essential to attaining financial success.

To do so, align your decisions with what matters most to you and prioritize the objectives that are in line with your long-term goals.

Doing this will put you on track toward achieving prosperity and abundance!

Ultimately, seek motivation and direction from the behaviors of successful individuals who have attained financial security.

Q: What are some common mistakes people make when trying to achieve financial freedom?

A: Far too often, people succumb to the temptation of short-term gains at the cost of their long-term financial well-being.

Overspending, taking on too much debt, and not planning for retirement are all potential pitfalls that can lead to financial instability.

An additional misstep is failing to ask for expert advice when necessary, such as consulting with a financial planner or tax specialist.

Lastly, without a well-defined course of action to achieve financial objectives, the path toward financial independence can become difficult.

It is essential to establish well-defined, measurable objectives and strive for them regularly over the long haul.

Q: How can I change my mindset if I have negative beliefs about money?

A: To shift your frame of mind, you must first recognize the negative thoughts and assumptions that are holding you back.

Once identified, attempt to replace them with more positive and motivating beliefs that will propel you forward.

This might involve questioning beliefs that were instilled in you during childhood, such as beliefs about money being scarce or that rich people are greedy.

To reach the pinnacle of financial success, it’s critical to motivate yourself with positive affirmations and envision yourself achieving your goals.

Visualize how capable and confident you will feel once you have accomplished them.

Make gradual moves toward your financial goals and commemorate each victory as you go.

This approach will shift your outlook towards an optimistic, bountiful attitude.

Q: How can I stay motivated when progress is slow or setbacks occur?

A: It can be difficult to stay motivated when there are roadblocks or the progress is slow, yet it’s important to keep your aspirations at the forefront and recognize all that you have achieved.

In order to maximize your chances for success, it is highly beneficial to find an encouraging confidant such as a friend or family member that can provide motivation and assurance.

Revel in your minor triumphs and accomplishments, and be kind to yourself when you face setbacks.

Instead of letting setbacks weigh you down, use them to your advantage and discover ways that you can learn and improve.

Keep your sights trained on where you want to be in the long run regardless of what obstacles may arise.

Last but not least, ask advice from those successful individuals who have accomplished fiscal autonomy, and bear in mind that accomplishing economic liberty is an exploration that demands persistence, devotion, and tolerance.